louisiana estate tax return

Louisiana State Tax Return - I had my taxes done and was E-filed 4 weeks ago. 1 have no impact on 2021 state income tax returns and payments due May 16.

Will The Irs Extend The Tax Deadline In 2022 Marca

Just because louisiana doesnt have an estate tax or inheritance tax doesnt mean youre in the clear as far.

. Under the federal estate tax law there is a credit for state death taxes that are paid up to a certain amount. Conclusions Louisianans enjoy a lot of estate and inheritance tax privileges. Federal Estate Tax Return Form 706 2 Ratio of assets attributable to Louisiana Louisiana gross estate to federal gross estate per federal return 3 State death tax credit attributable to Louisiana Multiply Line 1 by Line 2 4 Basic inheritance tax From Schedule III 5 Tax reduction under Act 818 of 1997 See instructions.

Fortunately only 1 or less of total households are required a file an estate tax return. Also there is no special tax calculation for this income and no need to file a separate return. Taxpayers can file their returns electronically through Louisiana File Online the states free web portal for individual tax filers.

Such estates or trusts may elect to be taxed at the rate of five percent on total gross income from Louisiana sources. Tax Rates Applied to Louisiana Taxable Income RS. This service is available 24 hours a day.

5495 For Form 709 gift tax discharge requests or when an estate tax return Form 706. 1 Total state death tax credit allowable Per US. For the remaining 194 million you will pay 776 000 taxes paid to the federal government.

How is estate transfer tax calculated. ESBTs on this return. Not The Slightest Need For Tax Hikes In 2021 Gas Tax Financial Asset Estate Tax.

It is one of 38 states in the country that does not levy a tax on estates. Ad Download Or Email Form LAT05 More Fillable Forms Register and Subscribe Now. There is a federal estate tax that may apply Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford.

Louisiana does not levy an estate tax against its residents. The estate transfer tax is only imposed on estates that are subject to federal estate taxation under the Federal Internal. They can also submit their returns using commercially available tax preparation software or with printed state returns available at wwwrevenuelouisianagovForms.

4810 for Form 709 gift tax only. First you will pay off the first 1 Million from the estate value. It will cost you 345800.

Yes Louisiana imposes an estate transfer tax RS. Baton Rouge LA 70802. Louisiana full-time residents part-year residents and nonresidents with Louisiana income sources and who are required to file a federal.

Louisiana Estate Tax Everything You Need To Know Smartasset G0lru4ywf Aq1m Share. But just because Louisiana does not have an estate tax does not mean that the same is true for the federal government. Louisiana estate tax return Sunday February 27 2022 Edit.

Date Tax due Returns and payments are due on May 15th of each year on the preceding years income or on the 15th day of the fifth month after the close of the taxpayers fiscal period. 617 North Third Street. Ad Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now.

But everybody should be aware of the rules. In total you will remit 1121800 as estate tax to own the property. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more.

Louisiana has completely eliminated taxes on any inheritance but for estates that are large enough to require a federal estate tax return there is a Louisiana Estate Transfer Tax. Who must file an estate transfer tax return. In 2001 federal law changed and no longer permitted a federal tax credit for taxes paid to the state.

Post Office Box 201. There is no estate tax in Louisiana. 473001 provides the tax to be assessed levied collected and paid upon the Louisiana taxable income of an estate or trust shall be computed at the following rates.

Revised Statute 472436 requires that an estate transfer tax return be filed by or on behalf of the heirs or legatees in every case where estate transfer tax is due or where the value of the deceaseds net estate is 6000000 or more. The estate transfer tax is only imposed on estates that are subject to federal estate taxation under the Federal Internal Revenue Code. Louisiana law used to require that an estate transfer tax return be filed if the decedents net estate was 60000 or more.

However if the estate or trust derived income from louisiana sources the filing of a louisiana fiduciary income tax return is required. To pay LA tax you can pay online or mail your return to the Louisiana Department of Revenue with a payment if you owe to. The amount of the state estate tax is equal to the federal estate tax credit allowed for state death taxes.

The estate would then be given a federal tax credit for the amount of state estate taxes that were paid. Department of the Treasury. View more contact information for the Louisiana Department of Revenue.

Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine-month period This is required only of individual estates that exceed a gross asset and prior taxable gift value of 1206 million 2412 for couples in 2022. Baton Rouge LA 70821-0201. Individual Income Tax Resident Non-Resident Athlete Declaration of Estimated Income Taxes.

The federal estate tax exemption was 1170 million in 2021 and increased to 1206 in 2022.

What Is Schedule C Tax Form Form 1040

Business Taxes Annual V Quarterly Filing For Small Businesses Synovus

Understanding The 1065 Form Scalefactor

How To File Taxes For Free In 2022 Money

Louisiana Estate Tax Everything You Need To Know Smartasset

How To Qualify For Free Tax Filing Forbes Advisor

Avoid 6 Mistakes That Will Delay Your Irs Tax Refund

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

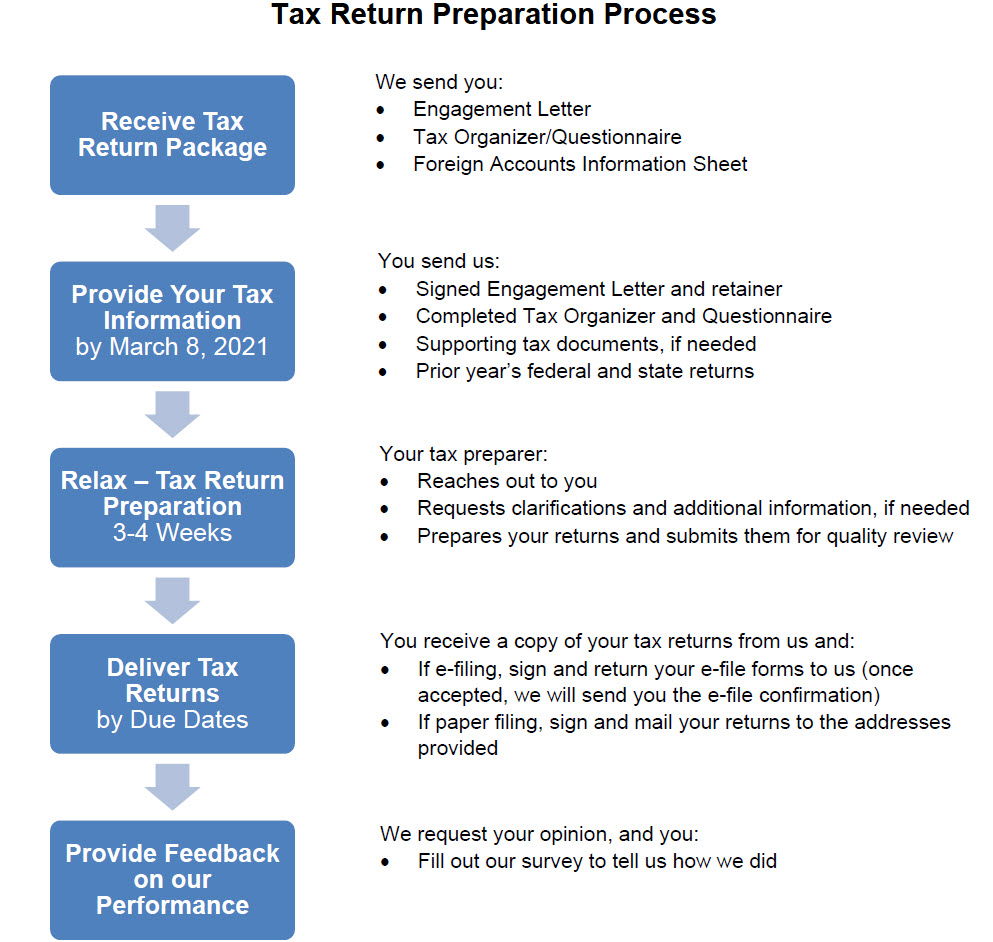

Tax Return Information The Wolf Group

Will My Executor Be Required To File An Estate Tax Return Vermillion Law Firm Llc Dallas Estate Planning Attorneys

:max_bytes(150000):strip_icc()/10402021-4522fd0d0a6d4ce392d3fd952db762fd.jpeg)

Form 1040 U S Individual Tax Return Definition

Louisiana Estate Tax Everything You Need To Know Smartasset

We Solve Tax Problems Debt Relief Programs Tax Debt Payroll Taxes

Why Some Americans Should Still Wait To File Their 2020 Taxes

Tax Return Refund Delays From The Irs Leave Triangle Residents Waiting For Thousands Of Dollars Abc11 Raleigh Durham